It doesn’t take long once you step into the world of real estate before you hear the term “Cap Rate.” In fact, rarely does a day in my life go by without hearing the phrase: “What’s the Cap?” For some, this question results in confusion. For others, it’s a rush of adrenaline as they await the answer to whether their new investment has been found. Let’s take a few moments to break down the Cap and de-mystify this most common of commercial real estate concepts.

What is a Cap Rate?

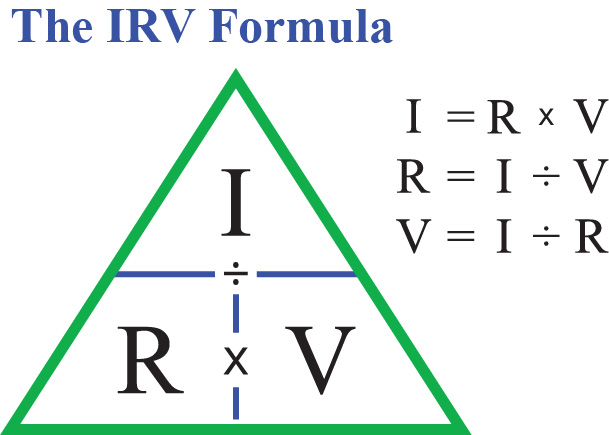

Cap Rate is short for “income capitalization rate” and is commonly used for analyzing income-producing properties. In its simplest definition, the Cap Rate (R), expresses the relationship between the property’s Net Operating Income (NOI) and the Value (V) of the property.

To take it one step further, because the Cap Rate is a ratio of three variables, if you know two of the variables you can calculate the third one. The relationship of these three variables is inverse, so if the Cap Rate goes up, the value goes down; if the Cap Rate goes down, the value goes up.

The 3 Formulas:

NOI (I) ÷ Cap Rate (R) = Sales Price (V)

$80,000 ÷ 8% = $1,000,000

NOI (I) ÷ Sales Price (V) = Cap Rate (R)

$80,000 ÷ $1,000,000 = 8%

Sales Price (V) x Cap Rate (R) = NOI (I)

$1,000,000 x 8% = $80,000

These formulas are commonly portrayed in this graphic:

How Do Cap Rates Affect Buyers and Sellers?

In its simplest interpretation, Buyers tend to look for higher Cap Rates when purchasing properties as higher Caps equate to lower purchase prices and higher returns. Conversely, sellers want to sell at lower Cap Rates which translate to a higher sale price for the property. Remember, it’s an inverse relationship between the Cap Rate and the value!

What Dictates Cap Rates in the Market?

There are several factors that can affect the Cap Rate for a property, here are a few:

Interest Rates – When rates are higher, banks lend less money to remain within their debt-to-income requirements. Lower lending ability decreases demand in the market leading to lower prices and higher Cap Rates.

Risk – The more risk associated with an investment the higher the Cap Rate should be to compensate an investor for that risk. Alternately, lower risk investments will attract more investor demand and have lower Cap Rates.

Condition – A property’s physical condition as well as the investment’s business fundamentals affect the Cap Rate. If a property has a high vacancy rate or operational challenges or functional obsolescence or any one of countless factors that can affect an actual or potential Net Operating Income, it will certainly be reflected in the value of the property and the return an investor can expect, also known as the Cap Rate.

What Doesn’t the Cap Rate Tell Us?

The Cap Rate is a great tool to give us a quick evaluation at a specific point in time. It doesn’t tell us the whole story though and seasoned investors know that it’s just a starting point in an investment analysis. So, what does the Cap Rate leave out of the analysis of an investment property?

Leverage – Cap Rate assumes a cash purchase and does not take into consideration any loan details which can significantly affect the potential upside and downside of an investment.

Trends – Cap Rate is calculated over a one-year span, usually the previous year’s NOI. It does not consider changes in income over time, vacancy fluctuations, rental concessions, etc. Just because the Cap may look great now, what does the trend over the last few years look like?

Appreciation – Not only is the Cap limited when looking back over several years, it also doesn’t account for any increases in the asset value due to increases in the income, lease rates and market/economic conditions in the future. For example, multi-family assets in the Phoenix area and many similar fast-growing markets around the country have been trading for very low Cap Rates with the assumption that the demand for apartments will continue pushing the lease rates higher in turn increasing the value of these properties. Over the last several years these assumptions have proven right, and investors have been rewarded for taking the risks.

Tax Benefits – Every investor tax strategy is unique but taking into account asset depreciation, cost segregation, 1031 exchanges, opportunity zones and other tax related benefits can impact the fundamentals of a real estate investment. This is why having a CPA and legal team well versed in commercial real estate investing is so important.

Now that you know the basics of capitalization rates, it’s time to learn more about making money in the real estate industry!

As always, if you have questions about your business and investment goals, I am happy to meet and help you build a strategy for your long-term success.